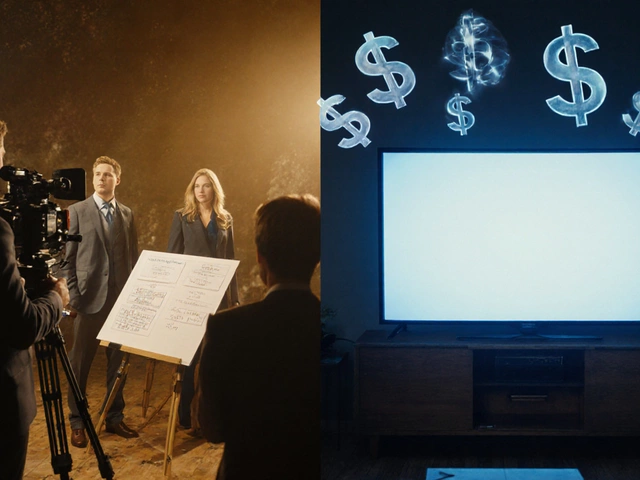

IRR Commercial Real Estate: What It Is and How It Drives Profit

When you invest in IRR commercial real estate, Internal Rate of Return is a metric that shows the annualized profit you earn from a property over its entire holding period, accounting for timing of cash flows. Also known as discounted cash flow return, it’s the go-to number for serious investors who don’t just want to know how much money they’ll make—but when they’ll get it. Unlike simple return numbers, IRR factors in when you put money in and when you pull it out. That’s why two deals with the same total profit can have wildly different IRRs—one might pay you back fast, the other might drag for years.

IRR doesn’t work alone. It’s usually checked against cap rate, a snapshot of a property’s first-year return based on net income divided by purchase price. Cap rate tells you the year-one yield, but IRR shows the full story: rent bumps, renovations, refinancing, and the final sale. Then there’s cash-on-cash return, a simpler metric that just compares annual cash flow to the cash you actually put in. Cash-on-cash is great for quick checks, but it ignores time. IRR doesn’t. If you’re comparing a five-year hold versus a ten-year hold, IRR is the only number that levels the playing field.

Commercial properties like office buildings, retail strips, or industrial warehouses are where IRR really shines. These aren’t single-family homes you flip in six months. They’re long-term plays. You might spend a year leasing up a building, then spend three years raising rents, then sell. IRR captures every step. That’s why you’ll see it in every professional deal memo, every investor pitch, every bank’s underwriting packet. It’s not just a number—it’s a language.

And here’s the catch: a high IRR isn’t always better. A 25% IRR over two years might look amazing, but if the property’s market crashes after you sell, you’re out of luck. A 15% IRR over ten years with steady rent growth and a strong tenant base? That’s the kind that builds wealth quietly. The best investors don’t chase IRR—they chase sustainable cash flow, solid locations, and time-tested demand. IRR just helps them measure if their strategy is working.

Below, you’ll find real-world breakdowns of how IRR stacks up against cap rate and cash-on-cash, how to calculate it without fancy software, and what numbers you should expect in today’s commercial market. No jargon. No fluff. Just what you need to know to spot a good deal—and avoid the traps.